What We Got Right to Retire Early

Our Best Financial Decisions

In order to retire so early — when Gillian was in her 30s and I was in my 40s — we got a few things right. Although we didn’t set out with early retirement as our goal, during life’s journey, we made a series of decisions, both big and small, that put us on a sound financial path. The end result was that we were able to say goodbye to corporate life at a relatively young age and pursue our dream of discovering the world full time.

Of course, we didn’t get everything right. We’ve also made a lot of mistakes along the way. In next week’s post and video, we’ll be sharing our most significant financial blunders. In the meantime, here are the top seven decisions that had the biggest positive impact on our ability to grow our wealth.

1. Graduating debt free

This one belongs to Gillian. She had a strong start in her financial journey by deciding to go to Canada’s Royal Military College and graduating debt free. Going to military college was not an obvious choice for her. Gillian had gone to a school for the arts and spent her formative years majoring in theatre.

However, there was a military recruiting centre close to her high school and she ended up joining the reserves to become a radio operator as a fun summer job. This put the military college on Gillian’s radar and she realized military college could be the ticket to a free university education plus a good job once she finished school.

It seemed like an adventure. She would see the world and hopefully do some good as part of the Canadian Forces. The financial element was initially just a side benefit that ultimately paid significant dividends. Instead of starting adult life saddled with thousands of dollars in debt, Gillian graduated debt-free with a business degree and had a job paying the equivalent of $30K USD year upon graduation. Plus she gained relevant skills for future jobs outside the military as a healthcare manager.

2. Tax-sheltered account

Unlike Gillian, I didn’t make it out of university debt free. However, when I got my first job out of university, I did open a tax-sheltered account and start making automatic monthly deposits.

This was a very significant financial decision for me at the time but I had it in my mind that it was an important part of becoming an adult. I had to open the account with a minimum deposit of $500. It took a lot of work to scrape that amount together as it represented a lot of my tiny after-tax paycheck. Then I needed to make room in my monthly budget for a $100 automatic deposit.

The big payoff: Even though my overall savings grew very slowly, this was the start of a lifelong savings habit that has served me well. Of course, as my income grew, I increased the amount of the automatic withdrawal until eventually we were both maxing out our tax sheltered investments each year.

3. Not owning a home

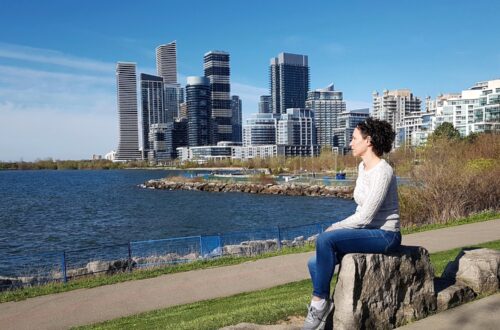

Another great decision was selling our first home and not buying again. When we moved to Singapore from Canada seven years ago, we had a choice: we could rent our Toronto condo and be overseas landlords or we could sell it. We decided against renting because we didn’t want to put the burden on our families to manage our property nor did we want to hire a property manager.

So we sold our condo and this was the right decision as we were immediately able to put this equity towards our investments. This became the basis of the wealth that we have built over the subsequent years and what eventually enabled us to retire early. Instead of our equity sitting in our primary residence, it’s working for us in investments and enabling us to travel the world.

We are not against home ownership by any stretch; whether it makes financial sense really depends on your local real estate market.

4. Not owning a car

Since 2013, we have not owned a car; we have relied on walking, public transit and the occasional cab. Prior to that, we owned a used car which was purchased for the equivalent of $11,000 USD. We sold it when we moved to Singapore and never bought again. By not owning a car for these past seven years, we also saved on insurance, gas, parking, maintenance, and repairs. A car is the type of purchase that you never really stop paying for.

Instead we lived in an urban environment which was well serviced by public transit that cost less than a dollar per ride. In fact, with our current lifestyle of full-time travel, it’s hard to picture owning a car again.

5. Self directed investing

The next great decision we made was to take over our own investments and choose low cost index funds. We’ll admit that there was a time when we didn’t feel confident to plan our own investments. We ended up buying into high fee mutual funds that ultimately didn’t outperform the market. We talk more about this in a post and video that goes into all the details of our investment strategy, including the mistakes we made along the way.

Once we sharpened our financial literacy and felt comfortable creating our own strategy, we exited the managed fund and moved into low fee index funds. We’ll talk more about the process of exiting and the financial impact (i.e. it wasn’t cheap!) when we share our money mistakes next week.

In the end, it was a sound decision to take over our investments and we are relieved that we won’t be paying high management fees for the next 30 to 40 years and beyond.

6. Tracking expenses

As we’ve admitted before, we were latecomers to the concept of tracking expenses. Of course, we were familiar with the ideas of tracking expenses and working within a budget. But we thought as long as we’re saving money, why do we need to track every penny.

Once we discovered financial independence, we made the decision to be more conscious about how we were spending our money, which included logging every expenditure. As soon as we started tracking our spending, we immediately started finding costs to cut. Thanks to the subsequent period of tracking, cost cutting and budgeting, we ended up increasing our savings rate to 70% in the year before we retired.

7. Working overseas

Everything we’ve touched on until now had a lasting positive influence on our net worth. But there was one decision that had the biggest impact on our financial journey: working overseas.

Seven years ago we relocated our lives and careers to Singapore, which is a high growth country with lots of jobs and opportunities. It also happens to have very low personal and business taxes. It was a big risk to move somewhere completely new where we had no friends and no network. It was a risk that paid off as moving to Singapore helped grow our careers and our salaries and it also helped us hold onto more of our earnings.

The lesson we share from this is to consider taking a risk with your career, although it doesn’t need to take the form of moving halfway across the world. Instead consider moving to a high growth market within your own country or a lower tax jurisdiction. You may find this to be the one tactic that supercharges your savings the way it did ours and gets you to financial independence even faster.